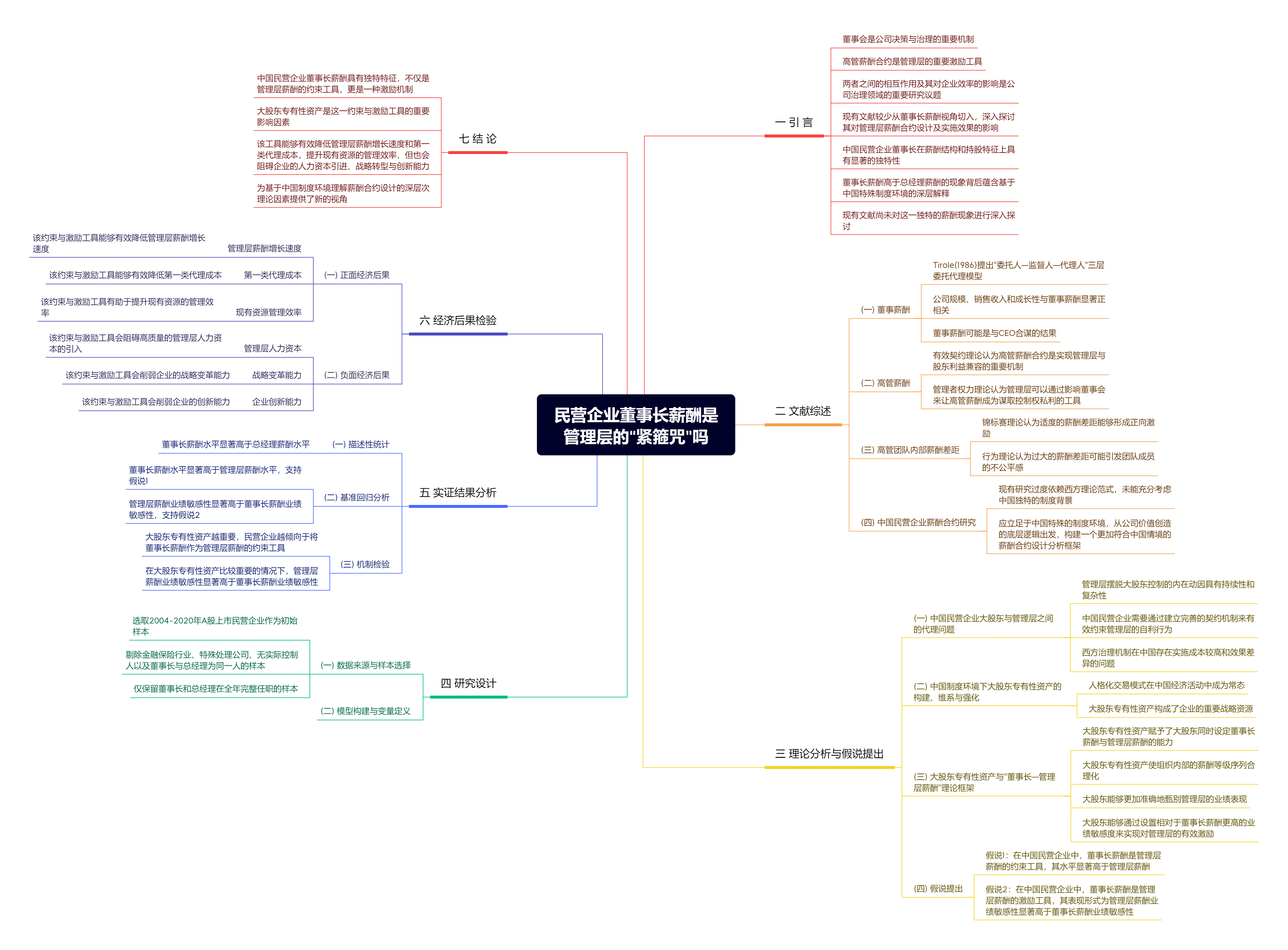

在西方企业治理实践中,董事长薪酬普遍低于总经理薪酬,而中国民营企业则呈现截然相反的薪酬结构特征。文章基于中国独特的人格化交易背景,从理论层面揭示了这一现象的内在逻辑:民营企业大股东通常持有并维系重要的专有性资产,这使其能够将董事长薪酬作为管理层薪酬的约束与激励工具。文章实证研究发现,在中国民营企业中,董事长薪酬发挥显著的约束功能,体现为董事长薪酬水平显著高于管理层薪酬;同时,董事长薪酬具有激励功能,体现为管理层薪酬业绩敏感性显著高于董事长薪酬业绩敏感性。在机制检验方面,文章从大股东专有性资产的形成过程、具体内容与表现形式、持有形式以及稳定性四个维度,系统衡量了大股东专有性资产的重要程度,研究结果均支持了大股东专有性资产对这一约束与激励工具的重要影响。进一步研究表明,采用这类“紧箍咒”式薪酬工具既产生了降低管理层薪酬增速、减少第一类代理成本和提高管理效率等正面经济后果,也带来了较难吸引高质量管理人才和阻碍企业转型创新等负面经济影响。文章的研究深化了对中国民营企业薪酬结构的理论认知,为优化企业治理机制和提升治理效能提供了重要的政策启示,对于推动中国特色现代企业制度建设具有重要的现实意义。

民营企业董事长薪酬是管理层的“紧箍咒”吗?——基于大股东专有性资产的解释

摘要

参考文献

相关附件

思维导图

2 陈冬华,范从来,徐巍. 公司治理新论(上)−一个中国社会关系结构的视角[J]. 会计与经济研究,2023a,(1):23−46.

3 陈冬华,范从来,徐巍. 公司治理新论(下)−一个中国社会关系结构的视角[J]. 会计与经济研究,2023b,(2):3−26.

9 李增泉. 关系型交易的会计治理−关于中国会计研究国际化的范式探析[J]. 财经研究,2017,(2):4−33.

10 林浚清,黄祖辉,孙永祥. 高管团队内薪酬差距、公司绩效和治理结构[J]. 经济研究,2003,(4):31−40.

12 王斌. 股东资源论[M]. 北京: 中国人民大学出版社, 2022.

13 许楠,刘浩,蔡伟成. 独立董事人选、履职效率与津贴决定−资产专用性的视角[J]. 管理世界,2018,(3):109−123.

16 张京心,廖子华,谭劲松. 民营企业创始人的离任权力交接与企业成长−基于美的集团的案例研究[J]. 中国工业经济,2017,(10):174−192.

18 朱滔. 董事薪酬、CEO薪酬与公司未来业绩:监督还是合谋?[J]. 会计研究,2015,(8):49−56.

19 Aghion P, Tirole J. Formal and real authority in organizations[J]. Journal of Political Economy,1997,105(1): 1−29. DOI:10.1086/262063

20 Barney J. Firm resources and sustained competitive advantage[J]. Journal of Management,1991,17(1): 99−120. DOI:10.1177/014920639101700108

21 Bebchuk L A, Fried J M. Executive compensation as an agency problem[J]. Journal of Economic Perspectives,2003,17(3): 71−92. DOI:10.1257/089533003769204362

22 Brick I E, Palmon O, Wald J K. CEO compensation, director compensation, and firm performance: Evidence of cronyism?[J]. Journal of Corporate Finance,2006,12(3): 403−423. DOI:10.1016/j.jcorpfin.2005.08.005

23 Cheng S. Managerial entrenchment and loss-shielding in executive compensation[R]. Ann Arbor: University of Michigan, 2005.

24 Cornelli F, Kominek Z, Ljungqvist A. Monitoring managers: Does It matter?[J]. The Journal of Finance,2013,68(2): 431−481. DOI:10.1111/jofi.12004

25 Cowherd D M, Levine D I. Product quality and pay equity between lower-level employees and top management: An investigation of distributive justice theory[J]. Administrative Science Quarterly,1992,37(2): 302−320. DOI:10.2307/2393226

26 Dah M A, Frye M B. Is board compensation excessive?[J]. Journal of Corporate Finance,2017,45: 566−585. DOI:10.1016/j.jcorpfin.2017.06.001

27 Faleye O. Classified boards, firm value, and managerial entrenchment[J]. Journal of Financial Economics,2007,83(2): 501−529. DOI:10.1016/j.jfineco.2006.01.005

28 Frankel R, Li X. Characteristics of a firm’s Information environment and the information asymmetry between insiders and outsiders[J]. Journal of Accounting and Economics,2004,37(2): 229−259. DOI:10.1016/j.jacceco.2003.09.004

29 Greif A, Tabellini G. The clan and the corporation: Sustaining cooperation in China and Europe[J]. Journal of Compara- tive Economics,2017,45(1): 1−35. DOI:10.1016/j.jce.2016.12.003

30 Groves T, Hong Y M, McMillan J, et al. China’s evolving managerial labor market[J]. Journal of Political Economy,1995,103(4): 873−892. DOI:10.1086/262006

31 Jensen M C, Meckling W H. Theory of the firm: Managerial behavior, agency costs and ownership structure[J]. Journal of Financial Economics,1976,3(4): 305−360. DOI:10.1016/0304-405X(76)90026-X

32 Jensen M C, Murphy K J. Performance pay and top-management incentives[J]. Journal of Political Economy,1990,98(2): 225−264. DOI:10.1086/261677

33 Johnson S, La Porta R, Lopez-de-Silanes F, et al. Tunneling[J]. American Economic Review,2000,90(2): 22−27. DOI:10.1257/aer.90.2.22

34 Li Z Q, Wong T J, Yu G. Information dissemination through embedded financial analysts: Evidence from China[J]. The Accounting Review,2020,95(2): 257−281. DOI:10.2308/accr-52521

35 Lu H, Shin J E, Zhang M Y. Financial reporting and disclosure practices in China[J]. Journal of Accounting and Economics,2023,76(1): 101598. DOI:10.1016/j.jacceco.2023.101598

36 Main B G M, O’Reilly III C A, Wade J. Top executive pay: Tournament or teamwork?[J]. Journal of Labor Econo- mics,1993,11(4): 606−628. DOI:10.1086/298309

37 Manne H G. Mergers and the market for corporate control[J]. Journal of Political Economy,1965,73(2): 110−120. DOI:10.1086/259000

38 North D C. Structure and change in economic history[M]. New York: W. W. Norton, 1981.

39 O’Reilly III C A, Main B G, Crystal G S. CEO compensation as tournament and social comparison: A tale of two theories[J]. Administrative Science Quarterly,1988,33(2): 257−274. DOI:10.2307/2393058

40 Oxelheim L, Clarkson K. Cronyism and the determinants of chairman compensation[J]. Journal of Business Ethics,2015,131(1): 69−87. DOI:10.1007/s10551-014-2260-2

41 Tirole J. Hierarchies and bureaucracies: On the role of collusion in organizations[J]. The Journal of Law, Economics, and Organization,1986,2(2): 181−214.

42 Williamson O E. The economic institutions of capitalism: Firms, markets, relational contracting[M]. New York: The Free Press, 1985.

43 Wong T J. Bridging relational networks and markets: Corporate governance, accounting information and relational contracts[R]. Los Angeles: University of Southern California, 2020.

44 Zhao Y H, Zhang X, Jiang W B, et al. Does second-order social capital matter to green innovation? The moderating role of governance ambidexterity[J]. Sustainable Production and Consumption,2021,25: 271−284. DOI:10.1016/j.spc.2020.09.003

引用本文

曹哲涵, 刘浩. 民营企业董事长薪酬是管理层的“紧箍咒”吗?——基于大股东专有性资产的解释[J]. 财经研究, 2024, 50(12): 152-166.

导出参考文献,格式为:

上一篇:省际结对帮扶与乡村振兴

3878

3878  6724

6724