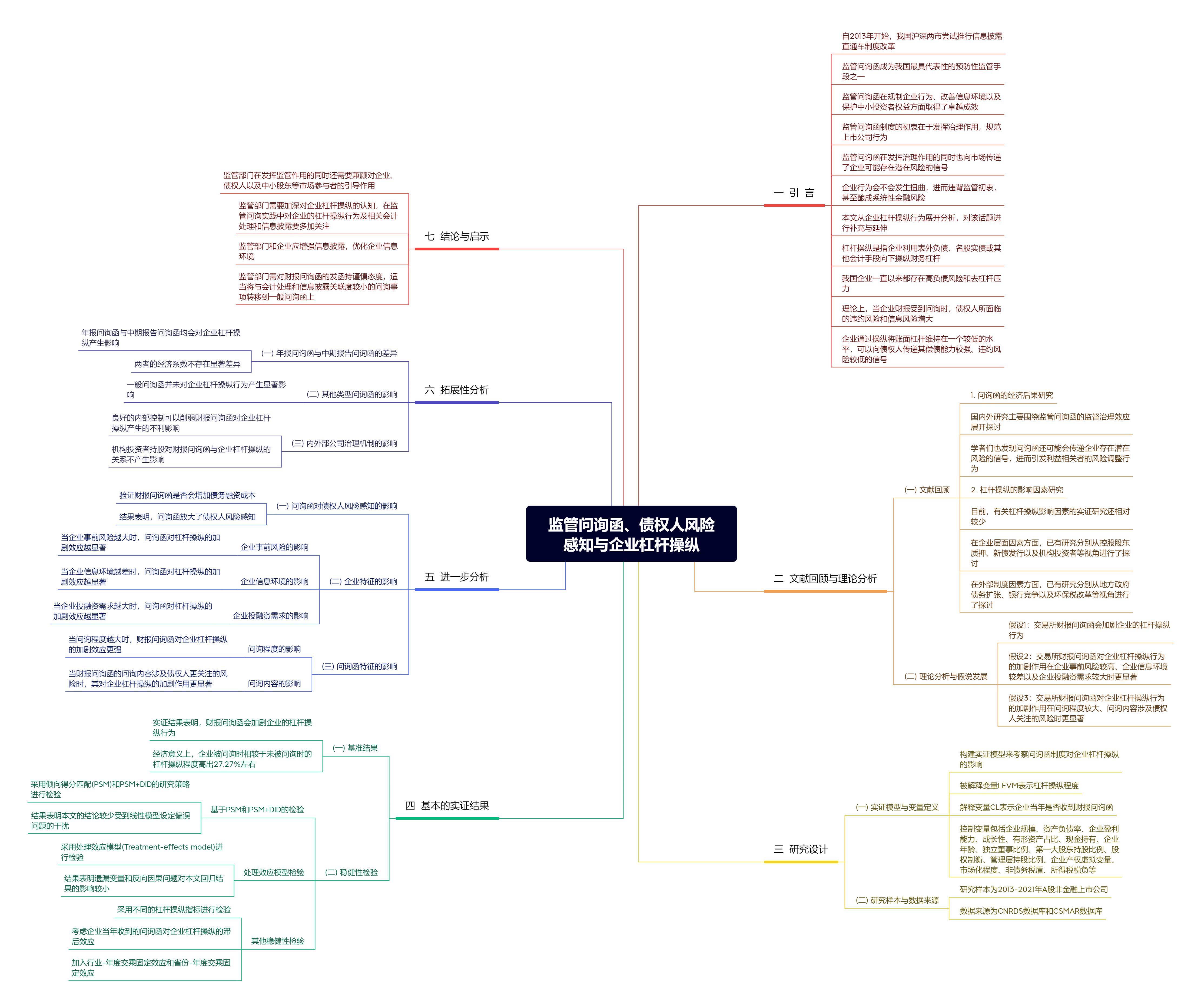

虽然监管问询制度的初衷在于发挥治理作用,维护资本市场稳定,但它也会向市场传递企业存在潜在风险的信号,进而对企业产生不利影响。这是否会扭曲企业行为,最终违背监管初衷呢?文章从杠杆操纵视角,以我国2013—2021年A股非金融上市公司为研究样本,发现财报问询函会加剧企业的杠杆操纵行为。机制分析表明,财报问询函引发了债权人风险感知,进而迫使企业通过杠杆操纵来维持企业投融资需求。文章还从企业特征和问询函特征两个方面进行了补充验证。在企业特征方面,该效应在事前风险较高、信息环境较差以及投融资需求较高的样本中更显著;在问询函特征方面,该效应在问询程度较高、问询内容涉及债权人风险时更显著。拓展性分析表明,无论是中期报告问询函还是年度报告问询函,均会对企业杠杆操纵产生影响;而相对于财报问询函,一般问询函并不会对杠杆操纵产生影响。此外,内部控制有效性可以削弱财报问询函对杠杆操纵的影响。文章的结论不仅补充了财报问询函和杠杆操纵的相关研究,还有助于进一步优化和规范我国监管问询制度,对防范企业隐性债务风险以及推动我国资本市场发展具有重要意义。

监管问询函、债权人风险感知与企业杠杆操纵

摘要

参考文献

相关附件

思维导图

7 李晓溪,饶品贵,岳衡. 银行竞争与企业杠杆操纵[J]. 经济研究,2023,(5):172−189.

17 张俊生,汤晓建,李广众. 预防性监管能够抑制股价崩盘风险吗?——基于交易所年报问询函的研究[J]. 管理科学学报,2018,(10):112−126.

18 Bens D A,Cheng M,Neamtiu M. The impact of SEC disclosure monitoring on the uncertainty of fair value estimates[J]. The Accounting Review,2016,91(2):349−375. DOI:10.2308/accr-51248

19 Bertrand M,Mullainathan S. Enjoying the quiet life? Corporate governance and managerial preferences[J]. Journal of Political Economy,2003,111(5):1043−1075. DOI:10.1086/376950

20 Bozanic Z,Dietrich J R,Johnson B A. SEC comment letters and firm disclosure[J]. Journal of Accounting and Public Policy,2017,36(5):337−357. DOI:10.1016/j.jaccpubpol.2017.07.004

21 Brown S V,Tian X L,Tucker J W. The spillover effect of SEC comment letters on qualitative corporate disclosure:Evidence from the risk factor disclosure[J]. Contemporary Accounting Research,2018,35(2):622−656. DOI:10.1111/1911-3846.12414

22 Cassell C A,Dreher L M,Myers L A. Reviewing the SEC’s review process:10-K comment letters and the cost of remediation[J]. The Accounting Review,2013,88(6):1875−1908. DOI:10.2308/accr-50538

23 Cunningham L M,Johnson B A,Johnson E S,et al. The switch-up:An examination of changes in earnings management after receiving SEC comment letters[J]. Contemporary Accounting Research,2020,37(2):917−944. DOI:10.1111/1911-3846.12546

24 Gietzmann M B,Isidro H. Institutional investors’ reaction to SEC concerns about IFRS and US GAAP reporting[J]. Journal of Business Finance & Accounting,2013,40(7−8):796−841.

25 Gietzmann M B,Pettinicchio A K. External auditor reassessment of client business risk following the issuance of a comment letter by the SEC[J]. European Accounting Review,2014,23(1):57−85. DOI:10.1080/09638180.2013.774703

26 Graham J R,Li S,Qiu J P. Corporate misreporting and bank loan contracting[J]. Journal of Financial Economics,2008,89(1):44−61. DOI:10.1016/j.jfineco.2007.08.005

27 Jensen M C,Meckling W H. Theory of the firm:Managerial behavior,agency costs and ownership structure[J]. Journal of Financial Economics,1976,3(4):305−360. DOI:10.1016/0304-405X(76)90026-X

28 Kubick T R,Lynch D P,Mayberry M A,et al. The effects of regulatory scrutiny on tax avoidance:An examination of SEC comment letters[J]. The Accounting Review,2016,91(6):1751−1780. DOI:10.2308/accr-51433

29 Li B,Liu Z B. The oversight role of regulators:Evidence from SEC comment letters in the IPO process[J]. Review of Accounting Studies,2017,22(3):1229−1260. DOI:10.1007/s11142-017-9406-2

30 Wang Q. Determinants of segment disclosure deficiencies and the effect of the SEC comment letter process[J]. Journal of Accounting and Public Policy,2016,35(2):109−133. DOI:10.1016/j.jaccpubpol.2015.11.005

引用本文

王晓佳, 毛新述, 于芙. 监管问询函、债权人风险感知与企业杠杆操纵[J]. 财经研究, 2024, 50(10): 124-138.

导出参考文献,格式为:

4776

4776  6008

6008