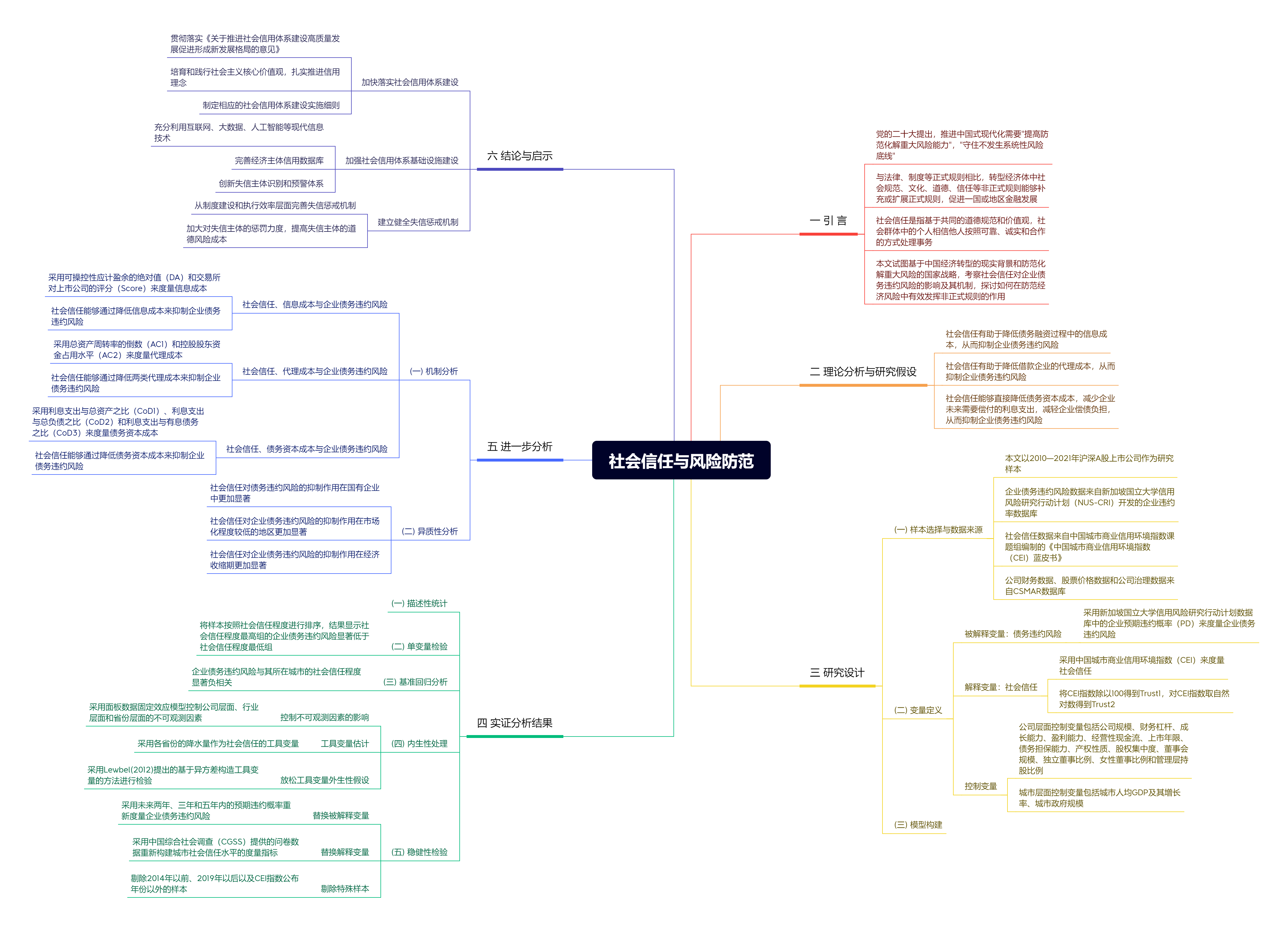

企业风险的形成和集聚是宏观风险的重要来源,探讨企业债务违约风险的缓解机制对于防范化解宏观经济风险具有重要意义。文章在非正式规则治理功能的框架下,探讨了社会信任对企业债务违约风险的影响及其机制。研究发现,以预期违约概率度量的企业债务违约风险与其所在城市的社会信任程度显著负相关,这一结论在经过多种内生性处理和稳健性检验后依然成立。债务融资过程中信息成本、代理成本和资本成本降低,是社会信任抑制企业债务违约风险的重要机制。此外,社会信任对企业债务违约风险的抑制作用在国有上市公司、市场化程度较低的地区以及经济收缩期更加显著。文章的研究不仅丰富了企业债务违约风险影响因素和缓解机制以及社会信任经济后果的相关文献,而且为有效发挥社会信任缓解宏观经济风险的积极作用提供了微观证据和政策启示。

社会信任与风险防范——基于企业债务违约风险的视角

摘要

参考文献

相关附件

思维导图

2 陈国进,王佳琪,赵向琴. 气候转型风险对企业违约率的影响[J]. 管理科学,2023,(3):144−159. DOI:10.3969/j.issn.1672-0334.2023.03.010

8 刘宝华,罗宏,周微,等. 社会信任与股价崩盘风险[J]. 财贸经济,2016,(9):53−66.

11 王化成,侯粲然,刘欢. 战略定位差异、业绩期望差距与企业违约风险[J]. 南开管理评论,2019,(4):4−19.

16 翟淑萍,缪晴,甦叶. “同治”还是“同谋”:机构投资者抱团与企业违约风险[J]. 南方经济,2022,(12):42−59.

17 张新民,叶志伟. 得“信”者多助?——社会信任能缓解企业短贷长投吗?[J]. 外国经济与管理,2021,(1):44−57.

18 Algan Y,Cahuc P. Inherited trust and growth[J]. American Economic Review,2010,100(5):2060−2092. DOI:10.1257/aer.100.5.2060

19 Brogaard J,Li D,Xia Y. Stock liquidity and default risk[J]. Journal of Financial Economics,2017,124(3):486−502. DOI:10.1016/j.jfineco.2017.03.003

20 Cassar A,Healy A,Von Kessler C. Trust,risk,and time preferences after a natural disaster:Experimental evidence from Thailand[J]. World Development,2017,94:90−105. DOI:10.1016/j.worlddev.2016.12.042

21 Chen D Q,Liu X J,Wang C. Social trust and bank loan financing:Evidence from China[J]. Abacus,2016,52(3):374−403. DOI:10.1111/abac.12080

22 Chkir I,Rjiba H,Mrad F,et al. Trust and corporate social responsibility:International evidence[J]. Finance Research Letters,2023,58:104043. DOI:10.1016/j.frl.2023.104043

23 Dak-Adzaklo C S P,Wong R M K. Corporate governance reforms,societal trust,and corporate financial policies[J]. Journal of Corporate Finance,2024,84:102507. DOI:10.1016/j.jcorpfin.2023.102507

24 Davis L. Individual responsibility and economic development:Evidence from rainfall data[J]. Kyklos,2016,69(3):426−470. DOI:10.1111/kykl.12116

25 Duan J C,Sun J,Wang T. Multiperiod corporate default prediction: A forward intensity approach[J]. Journal of Econometrics,2012,170(1):191−209. DOI:10.1016/j.jeconom.2012.05.002

26 Duarte J,Siegel S,Young L. Trust and credit:The role of appearance in peer-to-peer lending[J]. The Review of Financial Studies,2012,25(8):2455−2484. DOI:10.1093/rfs/hhs071

27 Dudley E,Zhang N. Trust and corporate cash holdings[J]. Journal of Corporate Finance,2016,41:363−387. DOI:10.1016/j.jcorpfin.2016.10.010

28 Gu L L,Liu Z Y,Ma S C,et al. Social trust and corporate financial asset holdings:Evidence from China[J]. International Review of Financial Analysis,2022,82:102170. DOI:10.1016/j.irfa.2022.102170

29 Guiso L,Sapienza P,Zingales L. The role of social capital in financial development[J]. American Economic Review,2004,94(3):526−556. DOI:10.1257/0002828041464498

30 Hasan I,Hoi C K,Wu Q,et al. Social capital and debt contracting:Evidence from bank loans and public bonds[J]. Journal of Financial and Quantitative Analysis,2017,52(3):1017−1047. DOI:10.1017/S0022109017000205

31 Howorth C,Moro A. Trustworthiness and interest rates:An empirical study of Italian SMEs[J]. Small Business Economics,2012,39(1):161−177. DOI:10.1007/s11187-010-9285-4

32 Jin M,Liu J S,Chen Z F. Impacts of social trust on corporate leverage:Evidence from China[J]. International Review of Economics & Finance,2022,77:505−521.

33 Kong D M,Zhao Y,Liu S S. Trust and innovation:Evidence from CEOs’ early-life experience[J]. Journal of Corporate Finance,2021,69:101984. DOI:10.1016/j.jcorpfin.2021.101984

34 Kuo N T,Li S,Jin Z. Social trust and the demand for audit quality[J]. Research in International Business and Finance,2023,65:101931. DOI:10.1016/j.ribaf.2023.101931

35 Lewbel A. Using heteroscedasticity to identify and estimate mismeasured and endogenous regressor models[J]. Journal of Business & Economic Statistics,2012,30(1):67−80.

36 Li X R,Wang S S,Wang X. Trust and stock price crash risk:Evidence from China[J]. Journal of Banking & Finance,2017,76:74−91.

37 Liu B H,Huang W,Chan K C,et al. Social trust and internal control extensiveness:Evidence from China[J]. Journal of Accounting and Public Policy,2022,41(3):106940. DOI:10.1016/j.jaccpubpol.2022.106940

38 Liu J R,Deng G Y,Yan J Z,et al. Unraveling the impact of climate policy uncertainty on corporate default risk:Evi- dence from China[J]. Finance Research Letters,2023,58:104385. DOI:10.1016/j.frl.2023.104385

39 Lyu X L,Ma J M,Zhang X C. Social trust and corporate innovation:An informal institution perspective[J]. The North American Journal of Economics and Finance,2023,64:101829. DOI:10.1016/j.najef.2022.101829

40 Meng Y J,Yin C. Trust and the cost of debt financing[J]. Journal of International Financial Markets,Institutions and Money,2019,59:58−73. DOI:10.1016/j.intfin.2018.11.009

41 Pevzner M,Xie F,Xin X G. When firms talk,do investors listen? The role of trust in stock market reactions to corporate earnings announcements[J]. Journal of Financial Economics,2015,117(1):190−223. DOI:10.1016/j.jfineco.2013.08.004

42 Qiu B Y,Yu J L,Chan K C. Does social trust restrain firm financing violations? Evidence from China[J]. Accounting & Finance,2021,61(1):543−560.

43 Shih Y C,Wang Y,Zhong R,et al. Corporate environmental responsibility and default risk:Evidence from China[J]. Pacific-Basin Finance Journal,2021,68:101596. DOI:10.1016/j.pacfin.2021.101596

44 Tian Y G,Ang J S,Fu P P,et al. Does social trust mitigate insiders' opportunistic behaviors? Evidence from insider trading[J]. Global Finance Journal,2024,59:100907. DOI:10.1016/j.gfj.2023.100907

引用本文

徐寿福, 李欣婷. 社会信任与风险防范——基于企业债务违约风险的视角[J]. 财经研究, 2024, 50(11): 34-49.

导出参考文献,格式为:

4904

4904  6345

6345