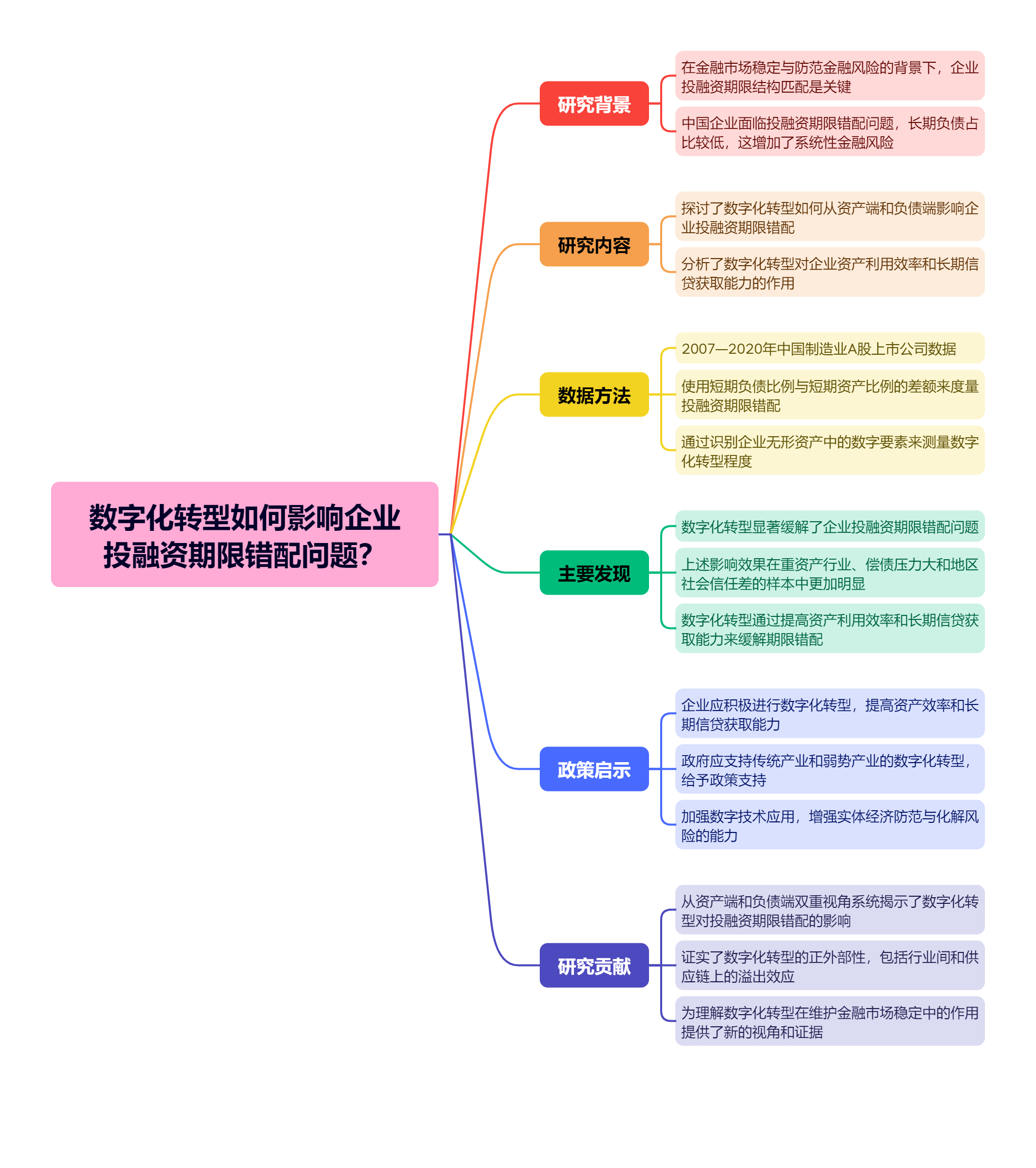

在维系金融市场稳定、防范金融风险的目标下,数字化变革为化解企业投资和融资期限结构不匹配难题提供了可参考的方法。文章从企业资产端和负债端双重视角,构建了数字化转型影响企业投融资期限错配的理论框架,为缓解实体经济投融资期限错配问题提供了新的证据。研究发现,数字化转型能够显著缓解企业投融资期限错配问题,并且影响效果在重资产行业、偿债压力较大和地区社会信任较差的样本中更明显。在作用机理方面,数字化转型从资产端提高了企业资产利用效率,从负债端加强了企业的长期信贷获取能力。此外,文章还发现数字化在行业间和供应链上均存在显著的溢出效应,这有助于进一步缓解企业、供应商和客户的投融资期限错配问题。经济后果检验表明,数字化转型能够降低当期投融资期限错配导致的破产风险,并且能够缓解投融资期限错配问题所导致的资源配置效率损失,但作用效果逐年下降。文章系统揭示了数字化变革缓解投融资期限错配的影响机制和经济后果,并为更好地推动企业数字化转型以实现企业可持续发展提供了有益参考。

数字化转型如何影响企业投融资期限错配问题?——基于资产端和负债端的双重视角

摘要

参考文献

相关附件

思维导图

6 赖黎,唐芸茜,夏晓兰,等. 董事高管责任保险降低了企业风险吗?——基于短贷长投和信贷获取的视角[J]. 管理世界,2019,(10):160−171. DOI:10.3969/j.issn.1002-5502.2019.10.014

20 王艳,李善民. 社会信任是否会提升企业并购绩效?[J]. 管理世界,2017,(12):125−140. DOI:10.3969/j.issn.1002-5502.2017.12.010

34 Acharya V V,Gale D,Yorulmazer T. Rollover risk and market freezes[J]. The Journal of Finance,2011,66(4):1177−1209. DOI:10.1111/j.1540-6261.2011.01669.x

35 Bahar D,Rapoport H. Migration,knowledge diffusion and the comparative advantage of nations[J]. The Economic Journal,2018,128(612):F273−F305. DOI:10.1111/ecoj.12450

36 Bernard A B,Moxnes A,Saito Y U. Production networks,geography,and firm performance[J]. Journal of Political Economy,2019,127(2):639−688. DOI:10.1086/700764

37 Billett M T,King T H D,Mauer D C. Growth opportunities and the choice of leverage,debt maturity,and covenants[J]. The Journal of Finance,2007,62(2):697−730. DOI:10.1111/j.1540-6261.2007.01221.x

38 Cheng H,Jia R X,Li D D,et al. The rise of robots in China[J]. Journal of Economic Perspectives,2019,33(2):71−88. DOI:10.1257/jep.33.2.71

39 Costello A M. Credit market disruptions and liquidity spillover effects in the supply chain[J]. Journal of Political Economy,2020,128(9):3434−3468. DOI:10.1086/708736

40 Denis D J,McKeon S B. Debt financing and financial flexibility evidence from proactive leverage increases[J]. The Review of Financial Studies,2012,25(6):1897−1929. DOI:10.1093/rfs/hhs005

41 Fan J P H,Titman S,Twite G. An international comparison of capital structure and debt maturity choices[J]. Journal of Financial and Quantitative Analysis,2012,47(1):23−56. DOI:10.1017/S0022109011000597

42 Javorcik B S. Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages[J]. American Economic Review,2004,94(3):605−627. DOI:10.1257/0002828041464605

43 Richardson S. Over-investment of free cash flow[J]. Review of Accounting Studies,2006,11(2):159−189.

44 Wang Y Z,Wang T,Chen L F. Maturity mismatches of Chinese listed firms[J]. Pacific-Basin Finance Journal,2021,70:101680. DOI:10.1016/j.pacfin.2021.101680

引用本文

申志轩, 祝树金, 汤超, 等. 数字化转型如何影响企业投融资期限错配问题?——基于资产端和负债端的双重视角[J]. 财经研究, 2024, 50(5): 139-153.

导出参考文献,格式为:

6301

6301  9572

9572