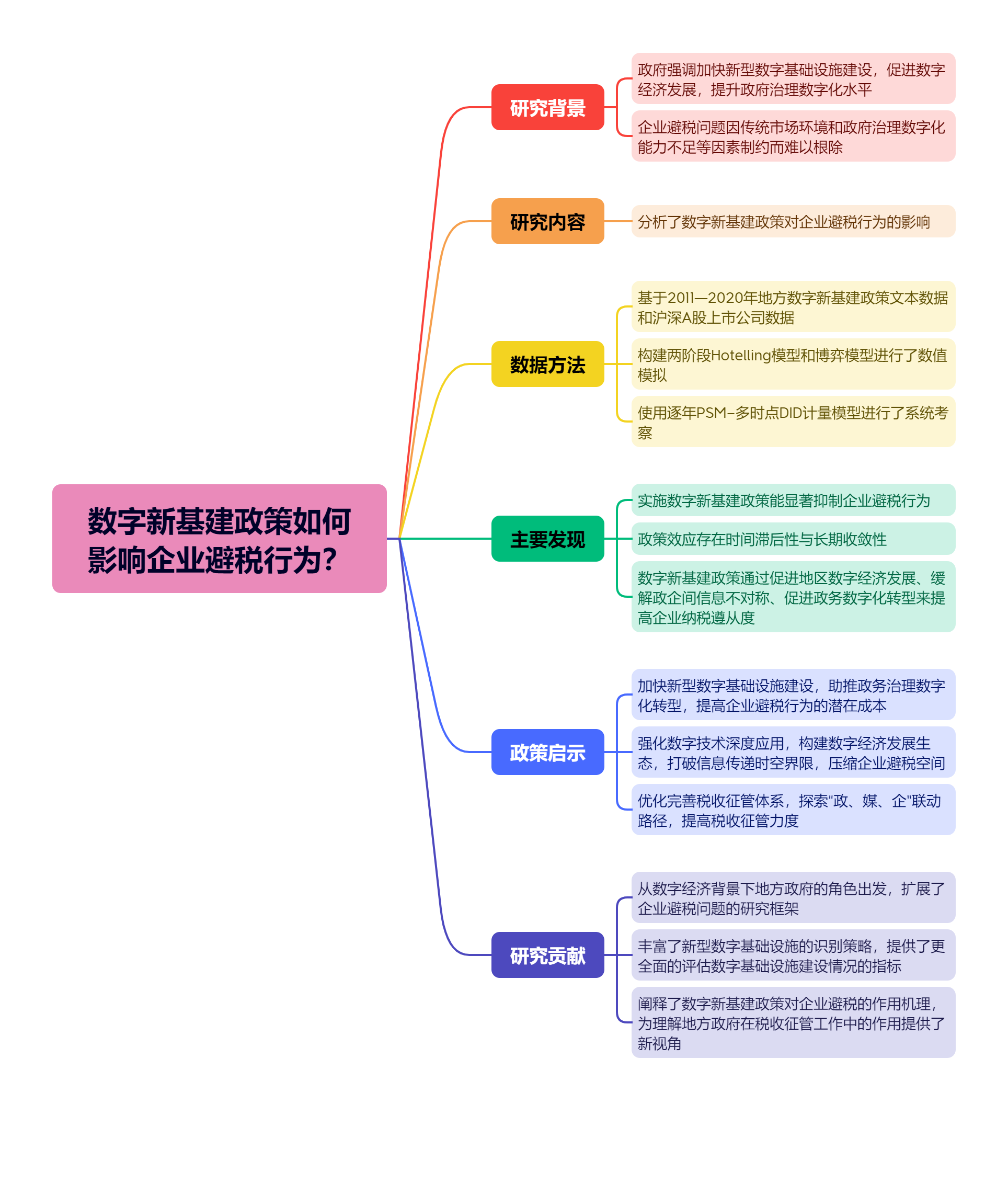

数字基础设施建设是中国政府促进数字经济发展、提升政府治理数字化水平的重要抓手,加快新型数字基础设施建设能否震慑企业避税行为有待明确。文章基于2011—2020年地方数字新基建政策文本数据,实证检验数字新基建政策对企业避税的影响。研究发现,实施数字新基建政策能抑制企业避税行为。基于宽带中国战略构造的双重差分模型检验结果验证了研究结论的稳健性。机制分析表明,数字新基建政策可以促进地区数字经济发展和缓解政企间信息不对称,并能助力政务数字化转型,抑制企业在应付账款方面的财务操纵行为,进而提高企业纳税遵从度。异质性分析结果显示,数字新基建政策的税收震慑效应在高税收征管力度地区、高媒体关注度和高数字化程度企业中更为明显。文章的结论为数字经济背景下的企业避税研究提供了新的视角,对于促进国家治理体系和治理能力的现代化建设也具有一定参考价值。

数字新基建政策如何影响企业避税行为?

摘要

参考文献

相关附件

思维导图

18 Agbo E I,Nwadialor E O. E-commerce and tax revenue[J]. Noble International Journal of Economics and Financial Research,2020,5(8):80−91.

19 Chari A,Liu E M,Wang S Y,et al. Property rights,land misallocation,and agricultural efficiency in China[J]. The Review of Economic Studies,2021,88(4):1831−1862. DOI:10.1093/restud/rdaa072

20 Chen S X. The effect of a fiscal squeeze on tax enforcement:Evidence from a natural experiment in China[J]. Journal of Public Economics,2017,147:62−76. DOI:10.1016/j.jpubeco.2017.01.001

21 Cheng H,Chen X W,Qi S S. Asymmetric corporate tax compliance:Evidence from a tax reform in China[J]. China Economic Review,2023,79:101967. DOI:10.1016/j.chieco.2023.101967

22 Emerick K,de Janvry A,Sadoulet E,et al. Technological innovations,downside risk,and the modernization of agriculture[J]. American Economic Review,2016,106(6):1537−1561. DOI:10.1257/aer.20150474

23 Giroud X. Proximity and investment:Evidence from plant-level data[J]. The Quarterly Journal of Economics,2013,128(2):861−915. DOI:10.1093/qje/qjs073

24 Gordon R,Li W. Tax structures in developing countries:Many puzzles and a possible explanation[J]. Journal of Public Economics,2009,93(7-8):855−866. DOI:10.1016/j.jpubeco.2009.04.001

25 Huang Z K,Li L X,Ma G R,et al. Hayek,local information,and commanding heights:Decentralizing state-owned enterprises in China[J]. American Economic Review,2017,107(8):2455−2478. DOI:10.1257/aer.20150592

26 Jin H H,Qian Y Y,Weingast B R. Regional decentralization and fiscal incentives:Federalism,Chinese style[J]. Journal of Public Economics,2005,89(9-10):1719−1742. DOI:10.1016/j.jpubeco.2004.11.008

27 Lü X B,Landry P F. Show me the money:Interjurisdiction political competition and fiscal extraction in China[J]. American Political Science Review,2014,108(3):706−722. DOI:10.1017/S0003055414000252

28 Uyar A,Nimer K,Kuzey C,et al. Can e-government initiatives alleviate tax evasion? The moderation effect of ICT[J]. Technological Forecasting and Social Change,2021,166:120597. DOI:10.1016/j.techfore.2021.120597

29 Xiao C R,Shao Y C. Information system and corporate income tax enforcement:Evidence from China[J]. Journal of Accounting and Public Policy,2020,39(6):106772. DOI:10.1016/j.jaccpubpol.2020.106772

30 Xu W C,Zeng Y M,Zhang J S. Tax enforcement as a corporate governance mechanism:Empirical evidence from China[J]. Corporate Governance:An International Review,2011,19(1):25−40. DOI:10.1111/j.1467-8683.2010.00831.x

引用本文

王海, 郭冠宇, 尹俊雅. 数字新基建政策如何影响企业避税行为?[J]. 财经研究, 2024, 50(3): 64-77.

导出参考文献,格式为:

上一篇:数字化消费政策的创业效应研究

5034

5034  9184

9184