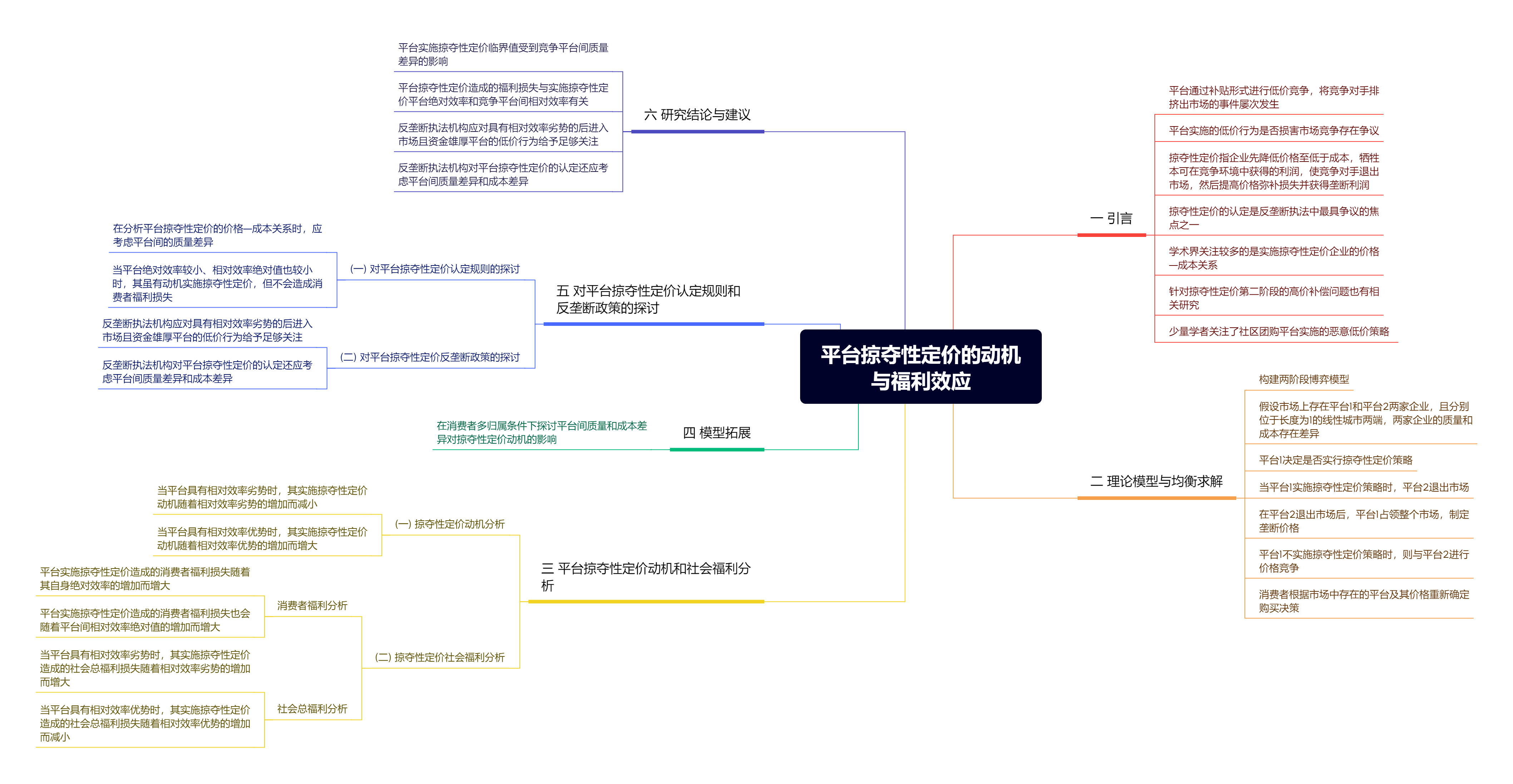

平台技术经济特征对传统掠夺性定价理论提出了挑战,平台掠夺性定价的认定值得深入探讨。文章以社区团购平台为例,在分析现实案例特征事实基础上,构建包括低价排他和高价补偿的两阶段横向差异化模型,分析了竞争平台间质量差异、成本差异对掠夺性定价动机和社会福利的影响及其作用机制,探讨了平台掠夺性定价认定规则和反垄断政策。研究结果表明:平台实施掠夺性定价的临界值随着其质量优势的增加而增大,随着其质量劣势的增加而减小;实施掠夺性定价平台的绝对效率和相对效率优势对掠夺性定价动机会产生正向影响;平台掠夺性定价造成的消费者福利损失随着其自身绝对效率的增加而增大,也会随着平台间相对效率绝对值的增加而增大;平台实施掠夺性定价造成的社会总福利损失随着其相对效率劣势的增加而增大,而随着其相对效率优势的增加而减小;当实施掠夺性定价平台具有相对效率劣势且绝对效率较高时,掠夺性定价会造成消费者福利损失和社会总福利损失。文章的研究结论为平台掠夺性定价的认定和反垄断执法提供了参考。

平台掠夺性定价的动机与福利效应*

摘要

参考文献

相关附件

思维导图

2 侯利阳. 数字经济对实体经济的冲击与因应:以社区团购的规制为视角[J]. 政治与法律,2022,(10):131−146.

3 李三希,武玙璠,鲍仁杰. 大数据、个人信息保护和价格歧视——基于垂直差异化双寡头模型的分析[J]. 经济研究,2021,(1):43−57.

4 林平. 论反垄断科学监管:决策理论分析及政策启示[J]. 中国工业经济,2022,(4):5−22. DOI:10.3969/j.issn.1006-480X.2022.04.001

5 王世强,陈逸豪,叶光亮. 数字经济中企业歧视性定价与质量竞争[J]. 经济研究,2020,(12):115−131.

6 王夏阳,陈思琦,郑茵予. 考虑渠道竞争的社区团购新零售问题研究[J]. 管理工程学报,2024,(5):104−117.

7 张晨颖. 平台掠夺性定价的反垄断思路——以反垄断法预防功能的限度为视角[J]. 东方法学,2023,(2):61−72. DOI:10.3969/j.issn.1007-1466.2023.02.005

8 Amelio A,Giardino-Karlinger L,Valletti T. Exclusionary pricing in two-sided markets[J]. International Journal of Industrial Organization,2020,73:102592. DOI:10.1016/j.ijindorg.2020.102592

9 Areeda P,Turner D F. Predatory pricing and related practices under Section 2 of the Sherman Act[J]. Harvard Law Review,1975,88(4):697−733. DOI:10.2307/1340237

10 Armstrong M,Wright J. Two-sided markets,competitive bottlenecks and exclusive contracts[J]. Economic Theory,2007,32(2):353−380. DOI:10.1007/s00199-006-0114-6

11 Bakos Y,Halaburda H. Platform competition with multihoming on both sides:Subsidize or not?[J]. Management Science,2020,66(12):5599−5607. DOI:10.1287/mnsc.2020.3636

12 Baumol W J. Predation and the logic of the average variable cost test[J]. The Journal of Law and Economics,1996,39(1):49−72. DOI:10.1086/467343

13 Bolton P,Brodley J F,Riordan M H. Predatory pricing:Strategic theory and legal policy[J]. Georgetown Law Journal,2001,89:2239−2330.

14 Bordalo P,Gennaioli N,Shleifer A. Competition for attention[J]. The Review of Economic Studies,2016,83(2):481−513. DOI:10.1093/restud/rdv048

15 Crane D A. The paradox of predatory pricing[J]. Cornell Law Review,2005,91(1):1-66 .

16 Easterbrook F H. Limits of antitrust[J]. Texas Law Review,1984,63(1):1−40.

17 Elzinga K,Mills D E. Trumping the Areeda-Turner test:The recoupment standard in Brooke Group[J]. Antitrust Law Journal,1994,62(3):559−584.

18 Evans D S. The antitrust economics of multi-sided platform markets[J]. Yale Journal on Regulation,2003,20:325−381.

19 Fudenberg D,Tirole J. Pricing a network good to deter entry[J]. The Journal of Industrial Economics,2000,48(4):373−390. DOI:10.1111/1467-6451.00129

20 Fumagalli C,Motta M. A simple theory of predation[J]. The Journal of Law and Economics,2013,56(3):595−631. DOI:10.1086/672951

21 Joskow P L,Klevorick A K. A framework for analyzing predatory pricing policy[J]. The Yale Law Journal,1979,89(2):213−270. DOI:10.2307/795837

22 Jullien B,Sand-Zantman W. The economics of platforms:A theory guide for competition policy[J]. Information Economics and Policy,2021,54:100880. DOI:10.1016/j.infoecopol.2020.100880

23 Kaplow L. Recoupment and predatory pricing analysis[J]. Journal of Legal Analysis,2018,10:46−112. DOI:10.1093/jla/lay003

24 Karlinger L,Motta M. Exclusionary pricing when scale matters[J]. The Journal of Industrial Economics,2012,60(1):75−103. DOI:10.1111/j.1467-6451.2012.00473.x

25 McGee J S. Predatory price cutting:The Standard Oil (N. J. ) case[J]. The Journal of Law and Economics,1958,1:137−169. DOI:10.1086/466547

26 Milgrom P,Roberts J. Limit pricing and entry under incomplete information:An equilibrium analysis[J]. Econome- trica,1982,50(2):443−459. DOI:10.2307/1912637

27 Ordover J A,Saloner G. Predation,monopolization,and antitrust[A]. Schmalensee R,Willig R. Handbook of industrial organization[M]. Amsterdam:Elsevier,1989.

28 Ordover J A,Willig R D. An economic definition of predation:Pricing and product innovation[J]. The Yale Law Journal,1981,91(1):8−53. DOI:10.2307/795848

29 Posner R A. Antitrust law:An economic perspective[M]. Chicago:University of Chicago Press,1978:184-196.

30 Rochet J C,Tirole J. Two‐sided markets:A progress report[J]. The RAND Journal of Economics,2006,37(3):645−667. DOI:10.1111/j.1756-2171.2006.tb00036.x

31 Scherer F M. Predatory pricing and the Sherman Act:A comment[J]. Harvard Law Review,1976,89(5):869−890. DOI:10.2307/1340183

32 Vasconcelos H. Is exclusionary pricing anticompetitive in two-sided markets?[J]. International Journal of Industrial Organization,2015,40:1−10. DOI:10.1016/j.ijindorg.2015.02.005

33 Weyl E G. A price theory of multi-sided platforms[J]. American Economic Review,2010,100(4):1642−1672. DOI:10.1257/aer.100.4.1642

34 Williamson O E. Predatory pricing:A strategic and welfare analysis[J]. The Yale Law Journal,1977,87(2):284−340. DOI:10.2307/795652

引用本文

于左, 张二鹏. 平台掠夺性定价的动机与福利效应*[J]. 财经研究, 2024, 50(12): 137-151.

导出参考文献,格式为:

3629

3629  5353

5353