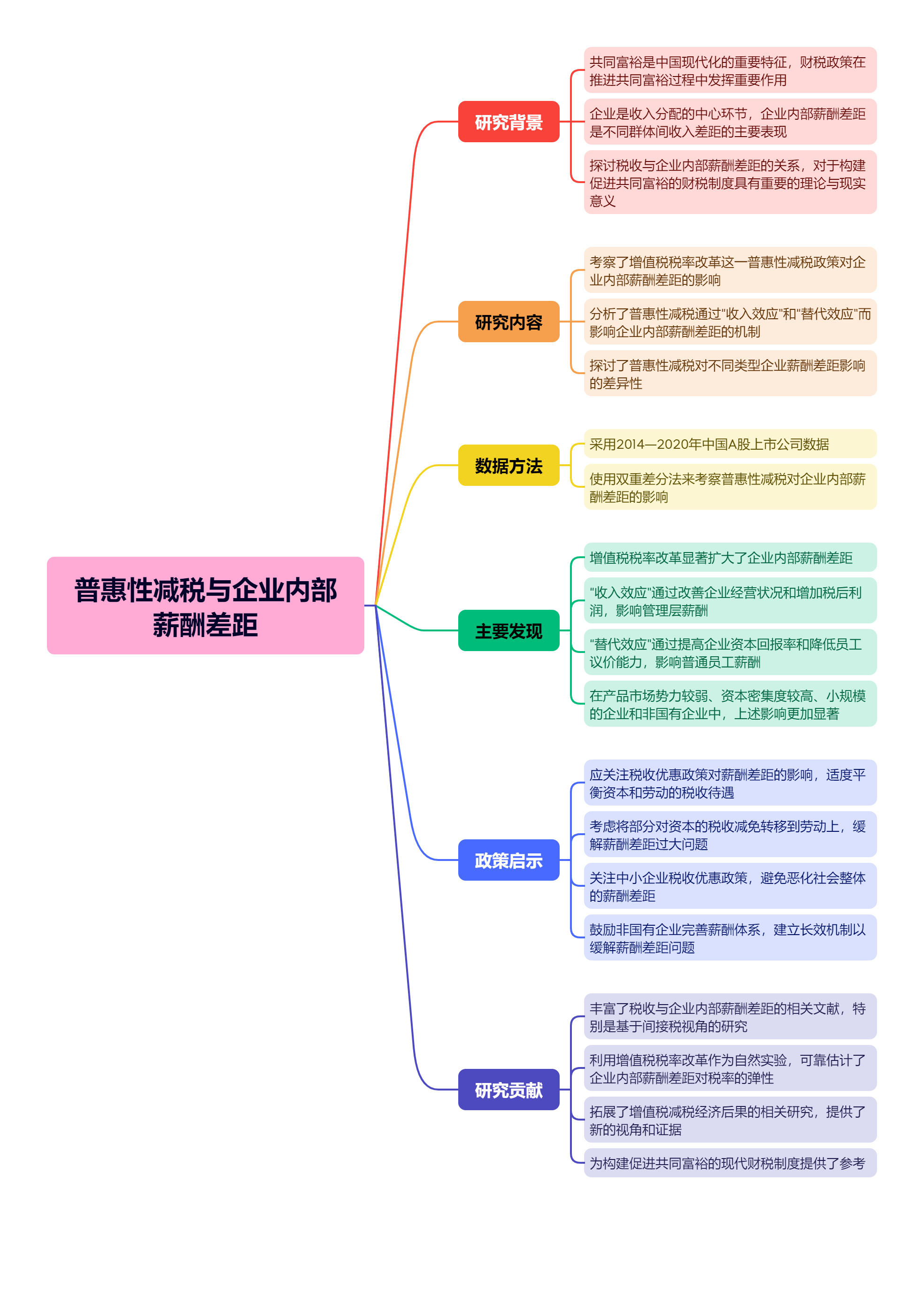

中国式现代化是全体人民共同富裕的现代化,在推进共同富裕的过程中,财税政策发挥着不可替代的作用。文章以中国从2017年开始实施的增值税税率下调改革为契机,使用双重差分法考察了普惠性减税对企业内部薪酬差距的影响。结果表明,增值税税率改革这一普惠性减税政策显著扩大了企业的内部薪酬差距。机制检验发现,普惠性减税主要通过“收入效应”和“替代效应”两条路径对企业内部薪酬差距产生影响。其中,“收入效应”提高了企业的盈利能力,增加了企业可分配的税后利润;“替代效应”提高了企业的资本回报率,使企业用资本替代劳动,降低了员工的议价能力。进一步地,前者主要影响管理层薪酬,而后者主要影响普通员工薪酬,从而导致高管薪酬提高,普通员工薪酬降低,企业内部薪酬差距扩大。异质性分析显示,普惠性减税对企业内部薪酬差距的影响在产品市场势力较弱、资本密集度较高、小规模的企业和非国有企业中更加显著。拓展性检验表明,普惠性减税在一定程度上导致企业超额薪酬差距扩大。文章的研究不仅为理解税收影响企业内部薪酬差距的内在机理提供了新的证据,也为构建促进共同富裕的现代财税制度提供了参考。

普惠性减税与企业内部薪酬差距——来自增值税税率改革的证据

摘要

参考文献

相关附件

思维导图

16 吕炜,王伟同. 健全与中国式现代化相适应的现代财政制度[N]. 人民日报,2023-03-21(13).

28 Atanasov V,Black B. The trouble with instruments:The need for pretreatment balance in shock-based instrumental variable designs[J]. Management Science,2021,67(2):1270−1302. DOI:10.1287/mnsc.2019.3510

29 Benzarti Y,Carloni D,Harju J,et al. What goes up may not come down:Asymmetric incidence of value-added taxes[J]. Journal of Political Economy,2020,128(12):4438−4474. DOI:10.1086/710558

30 Cengiz D,Dube A,Lindner A,et al. The effect of minimum wages on low-wage jobs[J]. The Quarterly Journal of Economics,2019,134(3):1405−1454. DOI:10.1093/qje/qjz014

31 Cobb J A. How firms shape income inequality:Stakeholder power,executive decision making,and the structuring of employment relationships[J]. Academy of Management Review,2016,41(2):324−348. DOI:10.5465/amr.2013.0451

32 Coles J L,Li Z C,Wang A Y. Industry tournament incentives[J]. The Review of Financial Studies,2018,31(4):1418−1459. DOI:10.1093/rfs/hhx064

33 Dai X,Gao F,Lisic L L,et al. Corporate social performance and the managerial labor market[J]. Review of Accounting Studies,2021,28(1):307−339.

34 De Chaisemartin C,D’Haultfœuille X. Two-way fixed effects estimators with heterogeneous treatment effects[J]. American Economic Review,2020,110(9):2964−2996. DOI:10.1257/aer.20181169

35 Fuest C,Peichl A,Siegloch S. Do higher corporate taxes reduce wages? Micro evidence from Germany[J]. American Economic Review,2018,108(2):393−418. DOI:10.1257/aer.20130570

36 Goodman-Bacon A. Difference-in-differences with variation in treatment timing[J]. Journal of Econometrics,2021,225(2):254−277. DOI:10.1016/j.jeconom.2021.03.014

37 Jacob M,Michaely R,Müller M A. Consumption taxes and corporate investment[J]. The Review of Financial Studies,2019,32(8):3144−3182. DOI:10.1093/rfs/hhy132

38 Jenter D,Lewellen K. Performance-induced CEO turnover[J]. The Review of Financial Studies,2021,34(2):569−617. DOI:10.1093/rfs/hhaa069

39 Kaplan S N,Klebanov M M,Sorensen M. Which CEO characteristics and abilities matter?[J]. The Journal of Finance,2012,67(3):973−1007. DOI:10.1111/j.1540-6261.2012.01739.x

40 Kenkel D S. Are alcohol tax hikes fully passed through to prices? Evidence from Alaska[J]. American Economic Review,2005,95(2):273−277. DOI:10.1257/000282805774670284

41 Saez E,Schoefer B,Seim D. Payroll taxes,firm behavior,and rent sharing:Evidence from a young workers’ tax cut in Sweden[J]. American Economic Review,2019,109(5):1717−1763. DOI:10.1257/aer.20171937

42 Serrato J C S,Zidar O. Who benefits from state corporate tax cuts? A local labor markets approach with heterogeneous firms[J]. American Economic Review,2016,106(9):2582−2624. DOI:10.1257/aer.20141702

43 Song J,Price D J,Guvenen F,et al. Firming up inequality[J]. The Quarterly Journal of Economics,2019,134(1):1−50. DOI:10.1093/qje/qjy025

引用本文

赵弈超, 刘行. 普惠性减税与企业内部薪酬差距——来自增值税税率改革的证据[J]. 财经研究, 2024, 50(5): 64-78.

导出参考文献,格式为:

上一篇:供应链数字化与供应链韧性

4524

4524  6175

6175